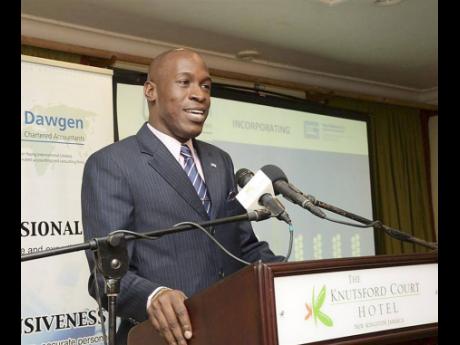

Dawkins Brown takes fight to Privy Council

Accountant loses appeal after being struck from professional roll

The Court of Appeal has dismissed an appeal by accountant Dawkins Brown, affirming the Public Accountancy Board’s (PAB) decision to strike him from the register and impose a J$1.6-million penalty for professional misconduct.

Brown, who heads the Crowe Horwath Jamaica accounting firm, had challenged the PAB’s ruling, arguing that the disciplinary process was flawed.

In a decision handed down on March 14, the court ruled that even if there were procedural defects, they amounted to “a mere irregularity which did not affect Brown’s fair trial rights”.

His attorney Hugh Wildman says Brown will be appealing to the United Kingdom (UK)-based Privy Council, Jamaica’s highest court.

“It’s being filed today. We have a very good case for the Privy Council. The court (Court of Appeal) recognised that it may be wrong on the gazetting point ... their interpretation and the case turns on that,” he told The Sunday Gleaner last Wednesday.

Professional misconduct

Brown, a then-registered public accountant, was found guilty of professional misconduct by the PAB in March 2020 following a complaint from Vistra IE (Bristol), a UK-based consulting company formerly known as Radius (Bristol).

The issue stemmed from a 2017 arrangement between Brown and Radius, involving sums amounting to over J$87 million that were allegedly not paid over to Jamaican tax authorities. Vistra was pursuing a business process outsourcing business in Jamaica.

Vistra contended that it engaged Crowe in 2017 to incorporate a subsidiary in Jamaica for its client, Affirmed Networks UK Limited. It said the local entity, Affirmed Network Jamaica Limited (ANJL), was created with Brown as the director, to be later replaced by persons nominated by Vistra.

Vistra said that between November 2017 and December 2018, it transferred a total of US$203,982 to UHY Dawgen Limited, which Brown owns, to enable Crowe to make monthly and annual tax payments on behalf of ANJL to Tax Administration Jamaica (TAJ).

According to the company, despite receiving the funds, Crowe failed to make the required payments, resulting in TAJ issuing a demand notice for payment of tax obligations by ANJL in January 2019.

Vistra alleged that, in response, Brown submitted documents for 2018 to TAJ falsely declaring that ANJL had no employees for that year, when in fact the company had four.

The company said that in an email on April 1, 2019, Brown sought to explain the failure to make the tax payments, stating that he was working to resolve the matter. Vistra said its lawyers issued a demand letter to Brown 15 days later, but, despite reminders, he failed to address the issue.

The complaint was filed with the PAB in July 2019.

Brown dismissed the allegations, arguing that he and his companies had no contractual relationship with Vistra, as the contract was between Crowe and Radius. He also said there was no contract between Crowe or ANJL and Vistra, and in the absence of any contractual relationship, the complaint was illegal.

He further argued that while Vistra claimed to have sent US$203,982.97 to UHY Dawgen for tax payments, Radius should have sent J$110 million.

According to Brown, Radius had a balance of J$84 million, and based on its alleged refusal to pay, provisional results were filed with TAJ. He said this is permissible under Jamaica’s tax law until matters are resolved.

Brown also contended that the 2017 agreement did not capture all aspects of the project, as from 2016, there was an oral agreement between himself and a Curt Olsen concerning the revenue share and flow of funds into ANJL for non-audit services. He said Olsen introduced him to Radius.

Brown said a dispute later developed between his company and Radius regarding the operation and the fees to be paid, which the parties agreed to settle through reconciliation.

He said that during the contract, Radius never requested the transfer of ANJL to them, and when he received the letter of complaint from Vistra, he stopped working on the project.

Brown said he took steps to stop filing and processing information under ANJL and to remove the employees who worked with Affirmed. He said this is why the filing with TAJ for 2018 showed no employees.

In its 2020 decision, the PAB accepted that Radius had changed its name to Vistra and that Brown, as managing partner of Crowe and a party to the 2017 letter of engagement, failed to make payments on behalf of ANJL to TAJ, despite having received US$203,982.97 from Vistra to do so.

The board also ruled that Brown “knowingly and deliberately” filed a false statement with TAJ and failed to uphold key professional standards, including the custody of client assets and professional behaviour.

It struck him from the Register of Public Accountants.

A Court of Appeal panel comprising President Marva McDonald-Bishop, Almarie Sinclair-Haynes, and David Fraser heard the appeal in February and July 2021. Fraser, who wrote the court’s unanimous opinion, offered “sincerest apologies” for the “significant delay” in delivering the judgment.

Brown, who heads the Crowe Horwath Jamaica accounting firm, contended that the tenure of the board that struck him from the roll had expired, and, therefore, the PAB had no jurisdiction to take such action.

However, the court ruled that the PAB’s decision remained “valid” based on the minister’s extension letters, the Interpretation Act, and other legal principles. The court acknowledged that the PAB members “were not formally reappointed with associated publication in the Gazette”.

Brown also argued that the PAB’s decision was invalid because it was not delivered in public, as required by regulation 33(3).

No breach of regulation

However, the appeal court ruled that the board’s method of pronouncement, followed by publication in the Gazette, satisfied the legal requirement. “There was, accordingly, no breach of regulation 33(3) that could vitiate the PAB’s decision,” it said.

Fraser also relied on the ‘ de facto officer doctrine’ to rule that the PAB decision was valid. The doctrine applies when an individual, without a valid legal appointment, performs duties of an office that protect public interest and prevent chaos.

The court also found that Brown had been duly informed of the decision and had exercised his right to appeal, further dismissing claims of unfair treatment.

Brown also argued that the PAB chairman, Linval Freeman, had demonstrated bias against him, but the court found no evidence to support this claim.

However, the appeal court did not admit the evidence and accepted the Government’s argument. It noted that Brown failed to raise the issue of bias at PAB hearings and submitted himself to the board’s jurisdiction over the complaint, waiving his right to challenge Freeman’s participation.

“In the light of this court’s refusal of the application to adduce fresh evidence in support of this issue, there is no evidence in support of these grounds of appeal,” the judgment stated. “By his deliberate failure to raise the issue of bias and his submission to the jurisdiction of the PAB, Brown waived his right to subsequently make this complaint.”

Brown’s attorney sought to get the appeal court to consider two pieces of ‘fresh’ evidence concerning Freeman.

Wildman alleged that two years before the PAB hearings, Freeman accused Brown of taking away an auditing and accounting contract that Freeman and his firm Ernst & Young had with Pan-Caribbean Sugar Company Limited. He also alleged that in 2006, Brown and Freeman had a personal dispute surrounding the acquisition of several cable companies by Columbus Communications where Freeman was the advisor-partner to the purchaser and Brown was the advisor-partner to the vendor.

The PAB’s findings were based on breaches of its rules concerning client asset management and professional behaviour. According to the decision communicated to Brown in March 2020, he was found guilty of “grave impropriety”, “conduct discreditable to the profession”, and “infamous conduct and gross negligence”.

The court ruled that Brown must pay the PAB’s legal costs.

Brown was represented by attorneys Wildman and Faith Gordon, while Faith Hall and Taneisha Rowe Coke from the Attorney General’s Chambers appeared for the PAB.