News

January 25 2026

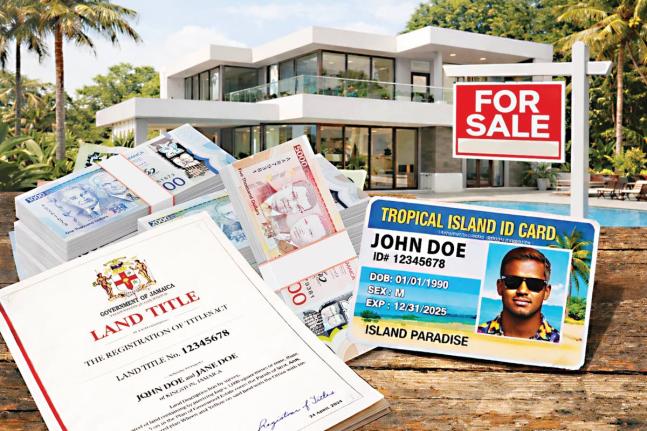

Fake IDs, stolen titles

Updated

January 26 2026

4

min read

Loading article...

Five financial institutions have been fleeced of more than $600 million through an elaborate and complex fraudulent scheme allegedly involving an upper St Andrew medical doctor and two accomplices, using a litany of fictitious documents, law enforcement operatives have disclosed.